Discover various information about Field Xpath Efile Return Efile Returnheader Efile Filer Efile Primaryssn here, hopefully fulfilling your information needs.

**XPath eFile Return: Navigating the Complexities of Electronic Filing**

In the ever-evolving landscape of tax administration, e-filing has emerged as a transformative tool, streamlining the submission of tax returns and reducing processing time. As electronic filing gains traction, understanding the intricacies of XML-based schemas, like XPath, becomes paramount. This article delves into the realm of XPath eFile returns, providing a comprehensive guide to help you navigate the complexities of electronic filing.

XPath, an acronym for XML Path Language, is a powerful tool used to traverse and select specific elements within an XML document. In e-filing, XPath plays a crucial role in identifying and extracting data from electronic tax returns, ensuring that the information is processed accurately and efficiently.

**Exploring the eFile Return**

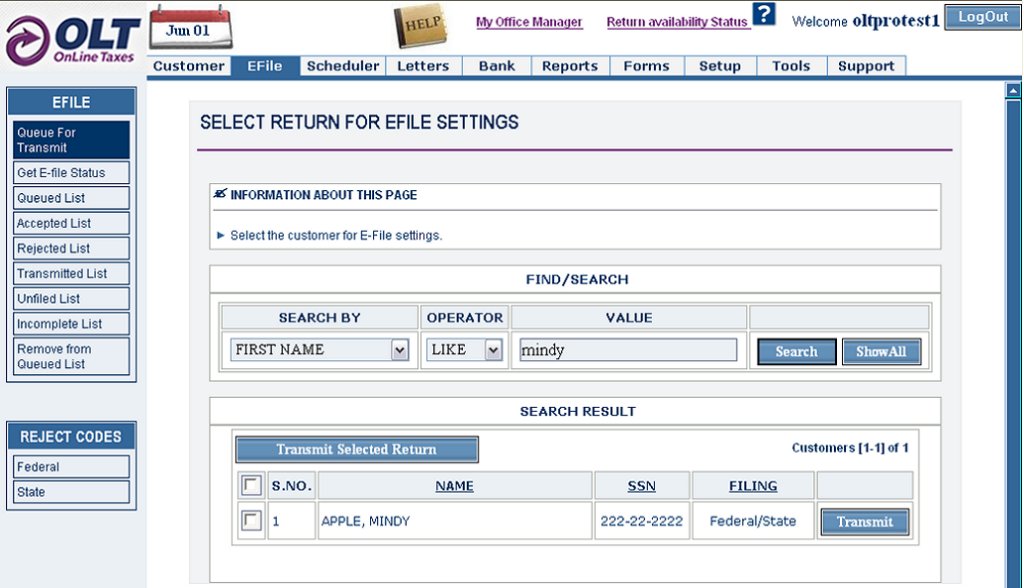

An eFile return is an XML document that represents a tax return submitted electronically. It consists of various sections, including the Return Header, Filer Information, and Tax Details. Each section contains specific data elements that conform to predefined schemas.

XPath expressions are used to navigate and select these data elements within the eFile return. For instance, the following XPath expression selects the primary Social Security Number (SSN) of the filer:

/Return/ReturnHeader/Filer/PrimarySSN

By constructing XPath expressions, tax preparers and software developers can efficiently extract and manipulate data from eFile returns, facilitating the electronic filing process.

**Delving into XPath Queries**

XPath expressions are composed of a series of steps, each separated by a forward slash (/). Each step represents a navigation operation, using specific syntax to select elements based on their name, attributes, or position.

For example, the following XPath expression selects all nodes named ‘Address’ within the ‘Filer’ element:

/Return/ReturnHeader/Filer/Address

Additionally, XPath supports a wide range of functions, such as ‘count()’, ‘substring()’, and ‘contains()’, which can be incorporated into expressions to perform complex data manipulations.

**Latest Trends and Developments**

The use of XPath in e-filing is continuously evolving as tax authorities introduce new schemas and requirements. It’s essential to stay abreast of these developments to ensure compliance and efficient processing of eFile returns.

Recent updates include the introduction of new data elements, such as the ‘ForeignAccountTaxComplianceAct’ indicator, and changes to the format of existing elements. By monitoring news sources, forums, and social media platforms, tax professionals can stay informed about these updates.

**Tips and Expert Advice for Navigating XPath eFile Returns**

Understanding XPath can empower you to navigate the complexities of eFile returns with ease. Here are some tips to help you get started:

- Familiarize yourself with the eFile schema and data elements.

- Use XML validation tools to ensure that your eFile returns are compliant with the schema.

- Leverage XPath expression builders or online resources to construct complex queries.

- Stay updated on the latest changes to the eFile schema.

- Consider consulting with an experienced tax professional for guidance on specific XPath expressions.

By implementing these tips, you can streamline your e-filing process and ensure accurate submission of your tax returns.

**Frequently Asked Questions (FAQs) on XPath eFile Returns**

Q: What is the purpose of XPath in e-filing?

A: XPath allows you to navigate and extract data from eFile returns, facilitating electronic filing and ensuring accurate processing.

Q: How do I construct an XPath expression?

A: XPath expressions consist of a series of steps, each separated by a forward slash (/), which select elements based on their name, attributes, or position.

Q: Where can I find resources to help me learn XPath?

A: There are numerous online tutorials, XML validation tools, and XPath expression builders available to assist you.

Q: How do I stay informed about updates to the eFile schema?

A: Monitor news sources, forums, and social media platforms for announcements from tax authorities regarding changes to the eFile schema.

Q: Is it necessary to consult a tax professional for XPath assistance?

A: While not always necessary, consulting with an experienced tax professional can provide valuable guidance on complex XPath expressions and ensure compliance with tax regulations.

**Conclusion**

XPath is an indispensable tool in the world of electronic filing, empowering tax professionals and software developers to navigate the complexities of eFile returns. By understanding the principles of XPath and staying abreast of the latest developments, you can leverage this powerful technology to streamline your e-filing process and ensure accurate and efficient submission of your tax returns.

Are you interested in learning more about XPath eFile returns? Connect with us today for expert insights and resources that can help you master the art of electronic filing.

Image: faq.mytaxexpress.com

You have read an article about Field Xpath Efile Return Efile Returnheader Efile Filer Efile Primaryssn. Thank you for your visit, and we hope this article is beneficial for you.